There are no wild kangaroos in Alabama. So when one was spotted on the interstate, people assumed it escaped from a zoo. It didn’t. It was someone’s pet—and it took cops, a tranquilizer, and Facebook Live to bring her home.

In today's dispatch, we're diving headfirst into:

Age Statements are Inbound: and that might not be a good thing

Worthy Reads: Sampling some of the best from around the web

Rewind: Some of our most popular Instagram posts from last week

The Whiskey Time Crunch

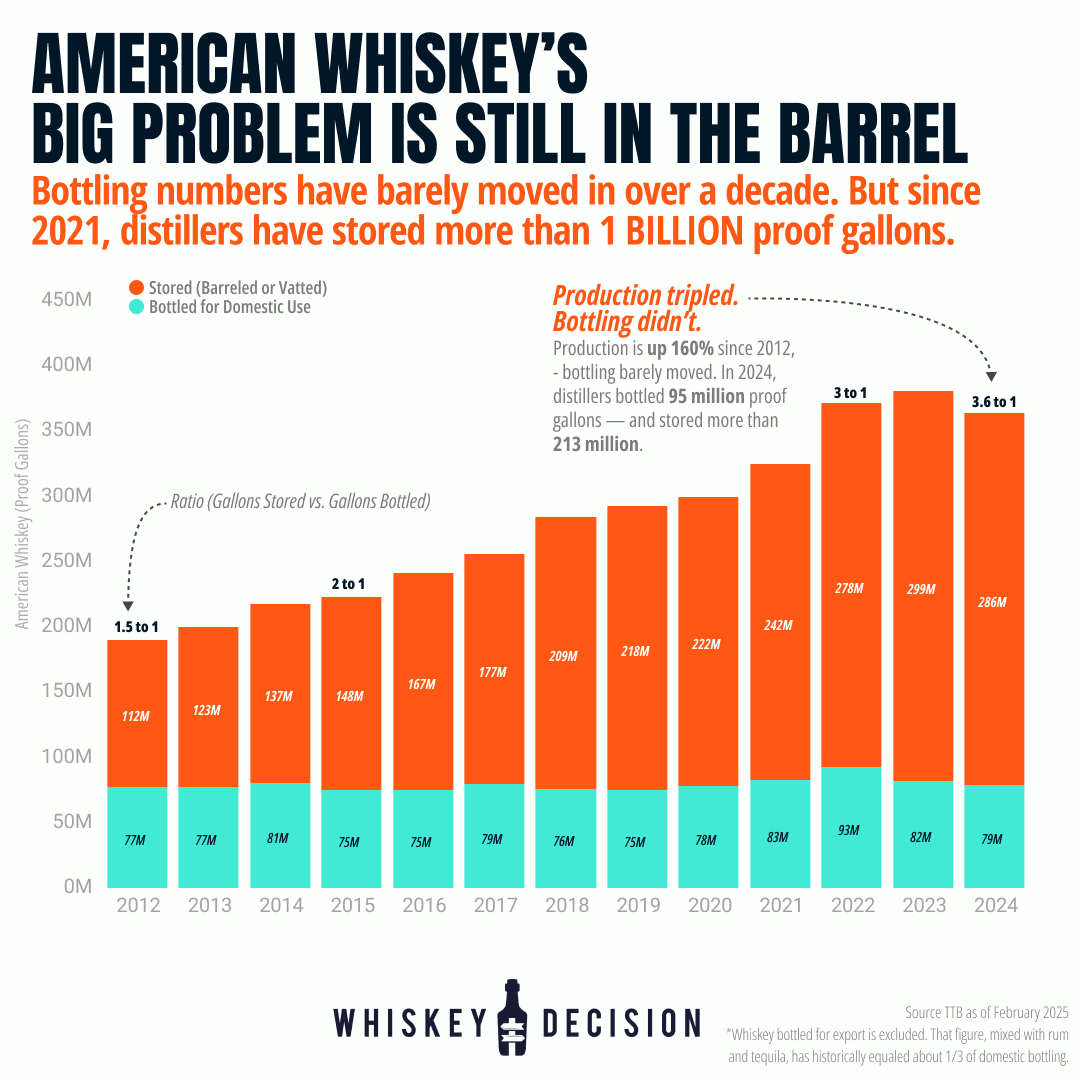

American whiskey is sitting on 1.4 billion proof gallons—the largest inventory on record. For more than a decade, barrels kept going in under the assumption they'd come out when the time was right. But in mid-2024, something shifted. Not because space ran out—rickhouses still have capacity. Distillers aren’t sure there’s enough demand to absorb what’s already aging.

The industry has room. What it lacks is confidence of the future.

Imagine you rented a storage unit in 2013. Just a stopgap—somewhere to park a few things until life settled down. But the months dragged on. You kept adding boxes, paying the bill, upgrading to a bigger space because it felt easier than sorting through the mess. You called it temporary. You called it flexible. But it wasn’t progress. It was deferral dressed as planning. And somewhere along the way, the cost stopped being financial. It became the burden of everything you didn’t want to deal with.

That’s where American whiskey is now.

There’s no pause button in whiskey. Once a barrel’s filled, the clock starts—and you can’t freeze a batch mid-aging. So, distillers did what they thought they had to: build rickhouses, buy stills, ramp up production, and brace for the payoff. But the market didn’t match the pace.

In 2024, output hit 308 million proof gallons—up 160% since 2012—while bottling barely cracked 95 million, about where it stood a decade ago. The gap isn’t just volume. It’s liability. Over a billion gallons have been pushed into storage since 2021. That backlog ties up cash, eats warehouse space, and adds pressure to recoup more than $250 million in annual carrying costs. And the barrels keep aging. Cash keeps shrinking.

At some point, you have to deal with what’s piling up. And here’s where the pressure shows: less than one in nine gallons bottled in 2024 actually sold through to domesitc consumers. And international demand isn’t growing either. The rest is sitting—on pallets, in warehouses, tied up in the system. The longer it waits, the harder it becomes to move, price, or justify.

Lately, that’s meant bottling older whiskey—whether the market’s ready or not. Between 2014 and 2019, we tracked 57 new American whiskeys aged 10 years or more came to market. From 2020 through 2025, that number jumped to 256.

But these aren’t all simply the result of careful long-term brand strategy. Many are first-time age statements releases, pushed forward by necessity. Whiskey that was once waiting for its moment is now being sold to recoup costs. The shelves make it look like a golden era for age-stated whiskey. The context tells a different story.

As of April 2025, seven brands have announced 16-year releases. Twenty-seven distilleries bottled 10- or 11-year whiskey last year, often for the first time. By 2030, an entire wave of distillers will have product eligible for 15-year labels. What began as post-pandemic cleanup is now a structural shift in what the market sees—and expects.

Forecasting whiskey demand a decade out is a reach even for the majors. They’ve got analysts and insulation. Smaller producers operate closer to the edge—balancing freight costs, label delays, and staff schedules just to keep product moving.

The target of success keeps shifting. Four years was the milestone—enough to signal quality, earn the bottled-in-bond badge, and enter the real market. Then six became the new standard, something that justified a premium. Now, it’s double digit age statements, and anything under $120 risks being seen as inferior.

What was once a plan is now a scramble to keep up. And for a lot of these distillers, it’s not strategy that’s driving the release—it’s the fact that waiting any longer might break them.

The Inventory Challenge

Look closely at the numbers and the scale becomes more revealing. Those 1.4 billion proof gallons represent enough whiskey to fill more than 32 million standard bottles every month for the next decade. That figure alone dwarfs current consumption rates. Optimism drove production schedules—and those barrels are now reaching maturity. What began as prudent (and maybe optimistic) planning now looks increasingly like a liability.

But the feedback loop in whiskey is slow. Distilleries expanded capacity since 2020, built new rickhouses1,2,3,4 bought more stills. And the carrying costs are steep. Industry estimates peg annual storage expenses north of $250 million just to keep current inventory in place. Every extra year thins margins, compresses options, and competes for warehouse space.

For consumers, the moment is oddly generous. Bottles that once seemed unreachable are suddenly sitting on shelves. The price-to-quality ratio for age-stated American whiskey has arguably never been better. The industry isn’t dominated by a handful of names anymore. Everyone’s fighting for shelf space, distributor attention, and consumer trust.

The storage unit metaphor still applies—but it’s bigger than just physical space. It’s about sunk costs, stalled decisions, and the weight of too many maybes. And for an industry built on the romance of time, it’s a cruel twist to discover that waiting too long might be the thing that breaks you.

The Next Bubble

Our biggest prediction… The industry’s old pricing shorthand—“$10 per year”—is breaking down. As distillers push more aged stock to market, they’re hitting the ceiling of what people are willing to pay.

For most drinkers, that ceiling lands between $65 and $100—not the $150+ needed to protect margins on decade-old barrels. Sure, a few 12-year bottles still land at $500, but those are outliers, not a model. What’s unfolding isn’t sustainable—it’s shelves filled with whiskey that’s too expensive to move and too common to feel special.

If you want us to dive deeper into the next bubble - give us a comment or send us DM.

📰 Worthy Whiskey News (a.k.a. our favorite reads)

$9 Billion Later, the Bourbon Trail Is No Longer Just About Whiskey

MLB Just Drafted Its First Whiskey—And It’s Already Playing in All 30 Ballparks

Denmark’s Most Ambitious Distillery Just Shut Off Its Stills—Now What?

BTAC Breaks Its 19-Year Streak—Here Comes E.H. Taylor Bottled-in-Bond

📸Rewind: A selection of our most popular IG Posts

BiB. NCF. SiB. If you’ve nodded along without knowing—this one’s for you.

Scotch Whiskey Auction volumes dropped 45%—but the real shift isn’t in the numbers.

So why is Jack Daniel’s a legend—and Dickel a punchline?

A $30 bottle. A $400 price tag. And a store that thought no one would notice.

What a week — whiskey, numbers, and highway kangaroos.

Thanks for flying with us. If you’ve got friends who appreciate a good pour and a better story, send this their way. We’re always looking to add more passengers on our bus.

Until next time, keep your bottles upright and your marsupials properly fenced in.

Cheers.

![[WD] You Can’t Pause Bourbon. And That’s a Problem.](https://media.beehiiv.com/cdn-cgi/image/fit=scale-down,quality=80,format=auto,onerror=redirect/uploads/asset/file/6f2933da-5ebf-4174-86cc-104611b90cab/Frame_1.png)